Our ambition is to help brands test different products simultaneously and without risk, on a platform very similar to Amazon or any other e-retailer - they can then make the most accurate fact-based choice when deciding on which products to put forward.

We have run our test to show how our tool can help make the right decision before selling any product.

Internal case objective: start selling wooden toys for kids up to 6 years old at Amazon.

Our idea is to run an end-to-end internal case in two phases:

- Phase 1: test different wooden toys to select the best-selling one and calculate its rentability

- Phase 2: launch in real Amazon the winning product, once proven it has a positive return, and check if its performance is in line with the results from phase 1.

We have tested 8 different wooden toys, quite similar among them, we want to launch 1 in Phase 2, so it is crucial to make sure we select the winning one.

We mimicked the Amazon result page for wooden toys with all best seller products and developed 8 experiments, each including one of our selected products. We ran 8 monadic experiments with 200 participants in each of them. Fieldwork lasted 4 days (1600 interviews) and results were available in just 2 working days.

See below the main Image of the 8 tested products.

Phase 1 Results

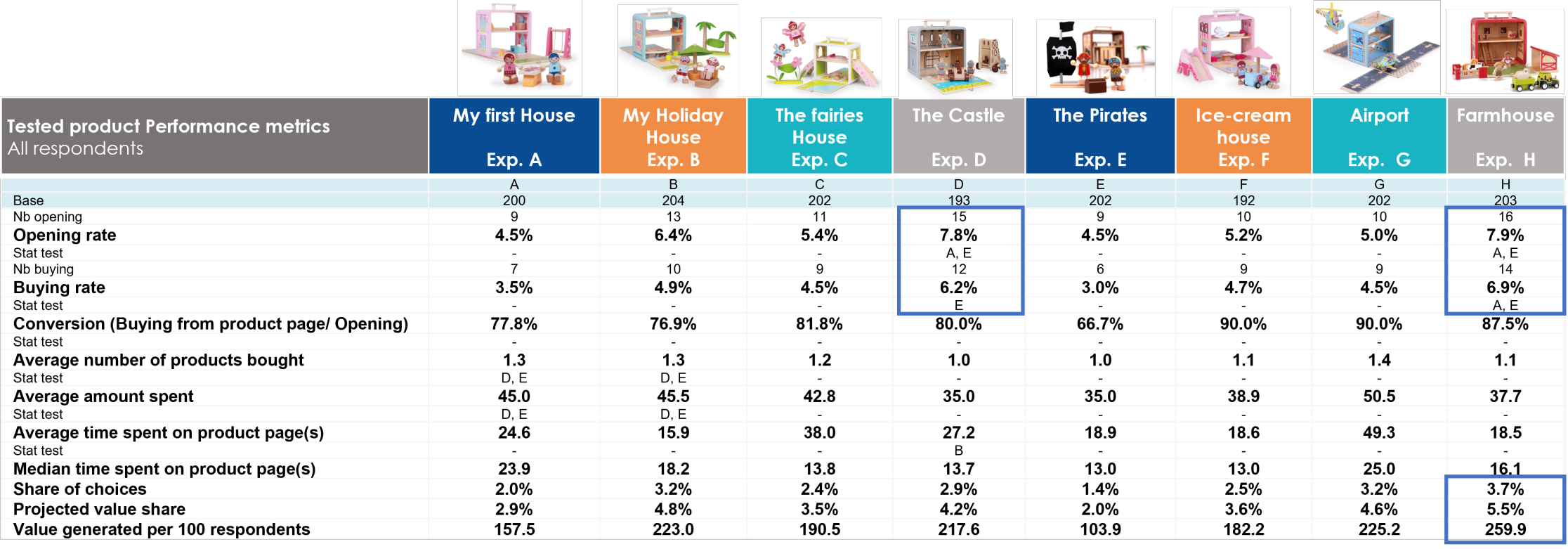

Two products were standing out both in terms of opening and buying rates: The castle (Exp. D) and the Farmhouse (Exp. H), this last one driving a higher share of choices and value share.

The best-performing product generated +175% more people opening the product page, +130% more people buying the product versus the least-performing proposition, and +150% more value generated.

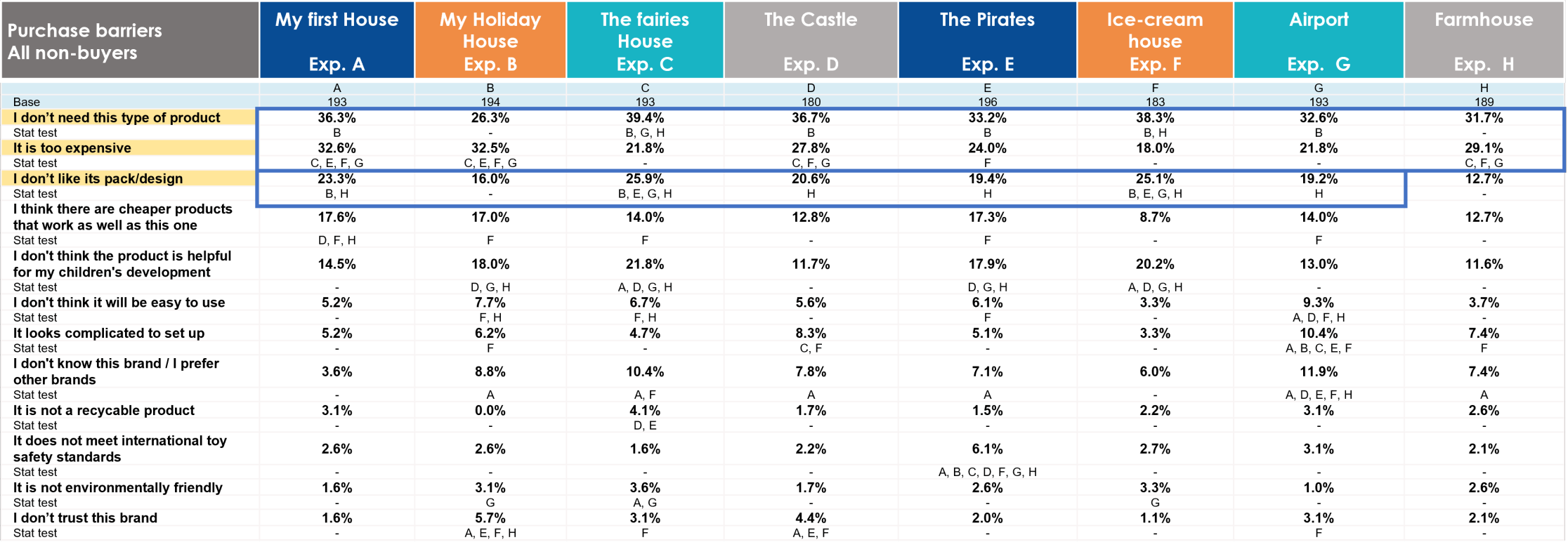

If we look at purchase barriers among non-buyers of the different tested products, we can see that the main ones are focused on not needing this kind of product, being too expensive, and not liking the design. This last point is not relevant in the Farmhouse.

Is this better performance enough to succeed in market?

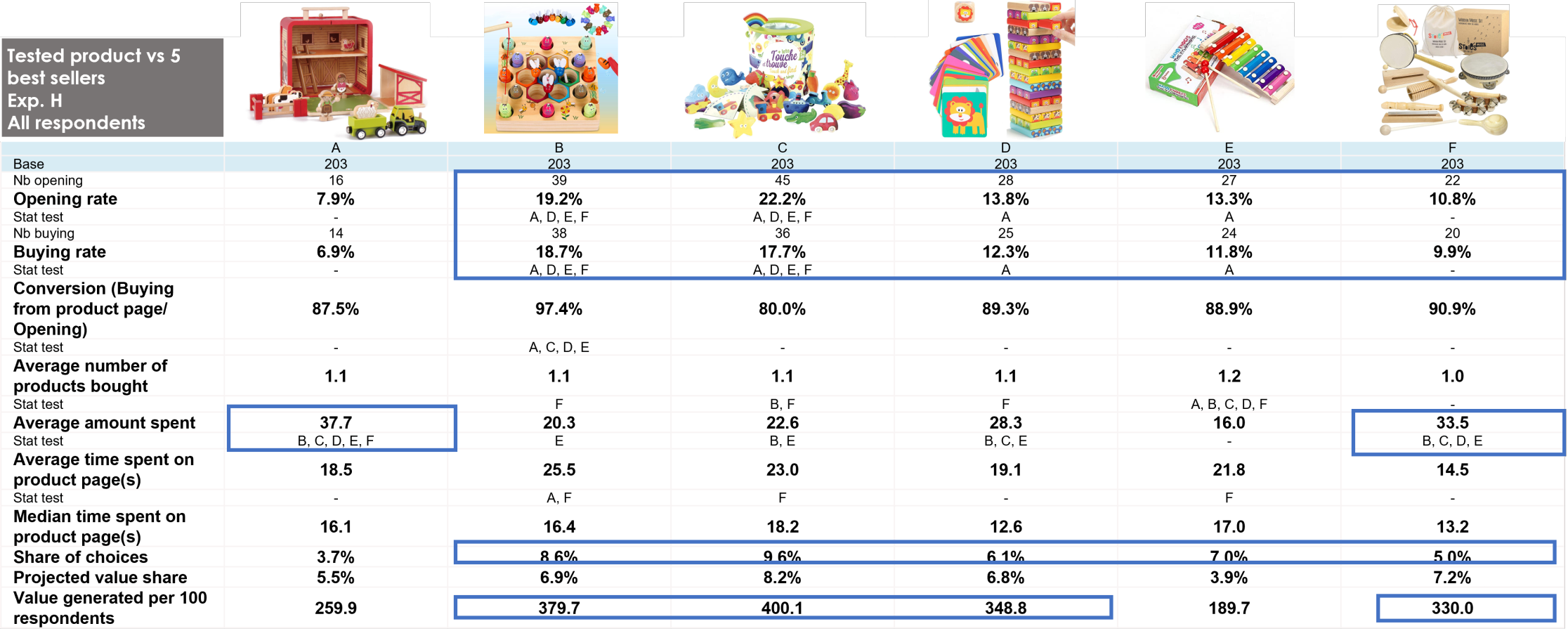

We know that the Farmhouse is outperforming the other tested products, but how does it do versus competitors?

The Farmhouse ranks 12 in terms of share of choices with a higher price versus the Top 5 best sellers. The opening rate level is again underperforming the Top 5 best sellers in this category. Competitors were chosen because they are perceived as more relevant as "wooden toys for kids".

Implications of Phase 1 results

Even if we had a clear winner, knowing its detailed performance and price are already real purchase barriers, we have estimated that the estimated sales are not enough for considering this product self-sustainable and profitable, as we cannot afford to reduce its price.

The final decision taken is not to launch any of the tested products.

Conclusion

We managed to avoid a wrong business decision in one week and a half.

Reach us in case you would like to start testing in a competitive environment your next products to be sold on Amazon. You can easily book some time to discuss the topic with us by clicking on this link