Here`s an unpopular, possibly controversial opinion: Most consumer research is deeply

flawed. Too often, businesses spend a lot of time and money asking consumers what they want.

If I had asked people what they wanted, they would have said faster horses.

—Henry Ford

Although this quote is often erroneously attributed to the famous car maker, the sentiment rings true today when companies are developing new products. It usually starts with a survey, simply asking consumers what they think about a product or a concept. Maybe they`ll show them an image or two of a prototype, packaging, or just a logo.

Once they get their responses, they proceed to make and market the product based on the feedback they`ve received. But then they`re surprised when the product doesn`t perform the way they expected it to. A great example of this is the infamous Tropicana package rebranding in 2009, it paid $35 million for, only to lose about $20 million in sales in just one month.

Why Do Products Fail in These Contexts?

We believe it`s because the companies often ask customers what they want instead of observing what they do. Surveys and questionnaires are generally not monadic, meaning they present concepts one after the other, and not independently. They rarely depict products in a competitive context, and they sometimes even ask respondents to compare different options for a single product, something that would never happen in the real world. Additionally, surveys can sometimes hold inherent biases in the questions, guiding consumers` choices and responses, which ultimately skews the results.

Instead of taking this approach, we believe companies should focus more on what consumers do in a realistic, competitive environment rather than what they say. Actions speak louder than words, right?

Case Study

We recently worked with an international client who was concerned that their most expensive product would not be able to compete against similar products with lower price points. Our goal was to identify which of three different product ideas

We also wanted to know what the top performing product`s main benefits and weak points were. The products shown below are not the products which were actually tested

If I had asked people what they wanted, they would have said faster horses.

—Henry Ford

Although this quote is often erroneously attributed to the famous car maker, the sentiment rings true today when companies are developing new products. It usually starts with a survey, simply asking consumers what they think about a product or a concept. Maybe they`ll show them an image or two of a prototype, packaging, or just a logo.

Once they get their responses, they proceed to make and market the product based on the feedback they`ve received. But then they`re surprised when the product doesn`t perform the way they expected it to. A great example of this is the infamous Tropicana package rebranding in 2009, it paid $35 million for, only to lose about $20 million in sales in just one month.

Why Do Products Fail in These Contexts?

We believe it`s because the companies often ask customers what they want instead of observing what they do. Surveys and questionnaires are generally not monadic, meaning they present concepts one after the other, and not independently. They rarely depict products in a competitive context, and they sometimes even ask respondents to compare different options for a single product, something that would never happen in the real world. Additionally, surveys can sometimes hold inherent biases in the questions, guiding consumers` choices and responses, which ultimately skews the results.

Instead of taking this approach, we believe companies should focus more on what consumers do in a realistic, competitive environment rather than what they say. Actions speak louder than words, right?

Case Study

We recently worked with an international client who was concerned that their most expensive product would not be able to compete against similar products with lower price points. Our goal was to identify which of three different product ideas

- Had the best commercial potential

- Stood out best vs. competition

We also wanted to know what the top performing product`s main benefits and weak points were. The products shown below are not the products which were actually tested

Product #1

Product #2

Product #3

To determine this, we conducted a hands-on digital experiment testing each product

individually in a realistic e-commerce marketplace setting relevant to the product category.

We recruited and screened members of the target audience, asking them to shop an e-commerce

page just as they would normally. We then tracked every single action each shopper took.

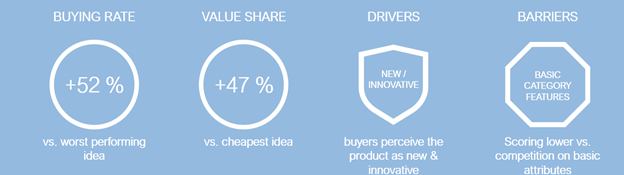

The result is that we were able to not only identify which product would perform best , but also how well it would likely perform in the real world. We learned that the best performing product was “purchased” at more than 50 percent the rate of the lowest performing product, earning nearly 50 percent more of the value compared to the least expensive option.

In other words, consumers were willing to pay a premium price for a product who`s features and benefits they valued. Despite the client`s concern that their premium product was too expensive to succeed in the marketplace, we found that shoppers perceived it as new and innovative, and thus was a good value for the price. At the same time, we also uncovered some of the barriers that stopped shoppers from choosing it, such concerns about some of the basic requirements of similar products in the category. These insights enabled us to make powerful, effective recommendations for how the product should be marketed and sold.

Here`s the Preferred Product performance

The result is that we were able to not only identify which product would perform best , but also how well it would likely perform in the real world. We learned that the best performing product was “purchased” at more than 50 percent the rate of the lowest performing product, earning nearly 50 percent more of the value compared to the least expensive option.

In other words, consumers were willing to pay a premium price for a product who`s features and benefits they valued. Despite the client`s concern that their premium product was too expensive to succeed in the marketplace, we found that shoppers perceived it as new and innovative, and thus was a good value for the price. At the same time, we also uncovered some of the barriers that stopped shoppers from choosing it, such concerns about some of the basic requirements of similar products in the category. These insights enabled us to make powerful, effective recommendations for how the product should be marketed and sold.

Here`s the Preferred Product performance

Had we simply asked consumers what they thought of these products, who knows what we would

have

heard. By taking a realistic approach, focusing on shopper behavior in a competitive

context, we

can formulate a more data-driven approach to sales and marketing that avoids

over-rationalization and potentially wrong recommendations.

By testing each product individually in a realistic shopping setting, we were able to garner significantly more actionable—and reliable—insights.

None of this is to say that consumer surveys aren`t helpful. They can provide some good information and direction on how to market a new product. But they should be starting points for further consumer research rather than seen as a definitive roadmap. Instead, we believe companies should test product concepts in realistic settings with real shoppers. Ultimately, what really matters is not whether customers “like” something or one design over another. What matters is buying performance.

In other words: Let shoppers shop.

Got a new product idea you want to test? We can help! Contact us to see how emazing-retailing`s testing platform can help your new products succeed in the marketplace.

By testing each product individually in a realistic shopping setting, we were able to garner significantly more actionable—and reliable—insights.

None of this is to say that consumer surveys aren`t helpful. They can provide some good information and direction on how to market a new product. But they should be starting points for further consumer research rather than seen as a definitive roadmap. Instead, we believe companies should test product concepts in realistic settings with real shoppers. Ultimately, what really matters is not whether customers “like” something or one design over another. What matters is buying performance.

In other words: Let shoppers shop.

Got a new product idea you want to test? We can help! Contact us to see how emazing-retailing`s testing platform can help your new products succeed in the marketplace.